Effective Ways to Reduce Your Medical Bills

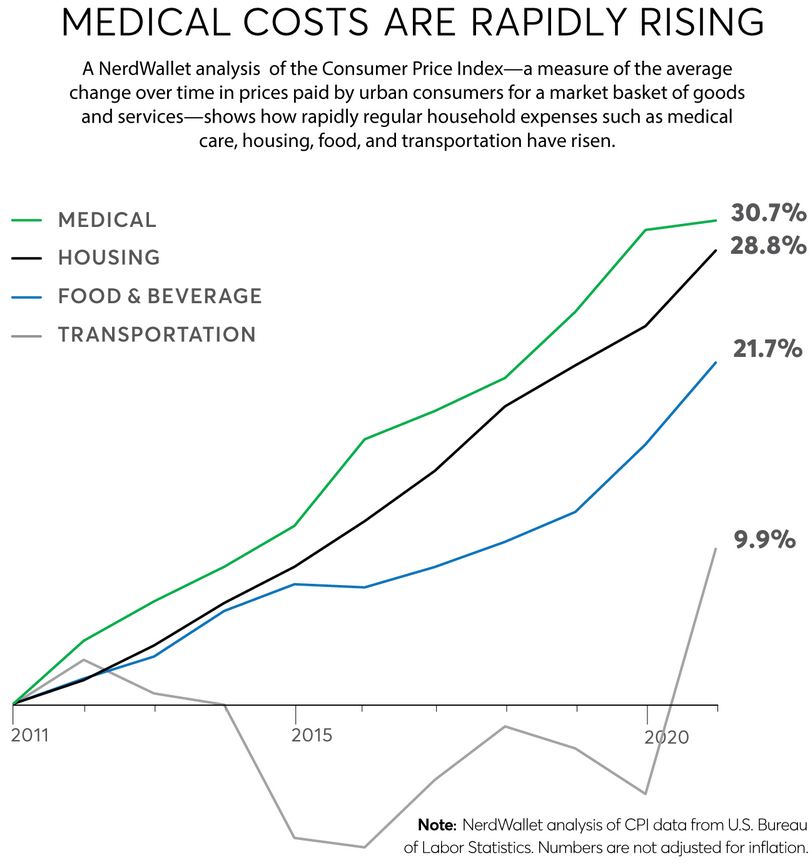

Since healthcare costs are a progressive sector, others may spend lots of cash on the same even with health insurance cover. Of course, there are ways to minimize these costs – before the treatment and after it has taken place.

Although today more US citizens than ever have health insurance, available at 90 percent, medical debts are a concern. Indeed, it has become even more of a phenomenon. According to the study by the Journal of the American Medical Association in 2021, medical debts in collections amount to more than $ 140 billion, topping all other forms of debt. This is a significant enhancement in the magnitude of what was estimated at $81 million in the study conducted in 2016. Preliminary data from the US Census Bureau, 2019, medical episode revealed that 17% of households have medical debt with an average balance of $2000.

For Medicaid and private insurance beneficiaries, high deductibles and copays are the largest portions. The other driver is the aggressive rise in the cost of health care over the period of a decade. According to Chuck Bell, a senior policy analyst at Consumer Reports the cost of healthcare has gone up in the last 10 years. “Year in and year out the pockets are being dipped into in a bid to arrive at an amount they can afford towards the treatment, which puts many users deep in the hole for ballooning bills.”

Moreover, it is very important to note that the CFPB reports that the most complaints it receives are related to medical debt. For instance, one participant from Utah said that a growing stack of bills left him unable to pay for the home credit. For instance, one of the participants who was from Florida noted that their medical bills brought a decrease in their credit score. A fourth participant from Louisiana said, “Then one day when I became sick and even developed medical bills that I could not meet, that is when I started incurring bills.”

It may sound unbelievable, but Medicare beneficiaries are not immune to the ordeal of medical bills they can never seem to pay off. Medical debt in households with a head of households of 65 years and above, according to the 2019 US census, is at 10 percent. Furthermore, a study conducted in 2010 indicated that of people aged 70 and above, the average out-of-pocket expenditure on medical expenses before their demise was more than $38000, a figure that might have increased today.

“About 44 percent of seniors have an annual income of $26,000 or less and 57 percent had less than $15,000 in savings,” notes Frederic Riccardi, president of the Medicare Rights Center, a consumer advocacy organization. For many seniors, it turns into an unaffordable necessity with payments for medicines implying cutting costs on food, not paying rent or mortgage, or not paying utility bills. Such obstacles are worse among the elderly Black and Latino people and sometimes they also miss out on critical healthcare services.

“Older people are likely to have more health problems; problems that are usually associated with high costs,” adds CR’s Chuck Bell. Hopefully, you have Medicare to help you pay the bills, but you know that getting through health care bureaucracy can be a real nightmare.

Recently, there have been actions to launch when medical bills go to collections for they can lead to extreme consequences, including damaging your credit score. However, alterations in the manner in which credit bureaus handle medical debts are meant to help. Since July 1, Equifax, Experian, and TransUnion, the three big credit reporting firms, will no longer do business this way. Now, if a medical bill has been paid it will not be reported to the credit bureau while those that are unpaid, will not appear on credit reports for the first 12 months from the time they were issued, up from 6 months as previously provided. From the first quarter of 2023, a bill that is unpaid and has a value of below $500 will not be reported to the credit bureaus at all. “These changes will bring relief to millions”, Bell continues. “However, the problem of cost remains a hurdle.”

In the next section, we provide guidance on how to avoid high medical expenses and what to do if you receive them anyway.

Get Ahead of Big Bills

It is worth taking only a small effort to cut down the healthcare costs to a considerable extent.

Explore costs before getting in. A recent law guarantees that thus-forth-such patients have the right to be given a ‘good faith estimate’ of such charges where a pre-scheduled procedure or test is involved. But people with insurance can still ask for this information, said Patricia Kelmar of the consumer group the U.S. PIRG. This estimate of all expected medical treatment costs is what you should provide your insurer. Thus, one can know what is included as well as how and for how much money, one is willing to spend.

Be truthful whenever you are at the doctor’s office. According to a CFPB issued in 2019, data showed that more people dread high medical costs than diseases. Still, consumers are reluctant to share their thoughts, especially about finances, with healthcare providers, according to Caitlin Donovan at the Patient Advocate Foundation. Your doctor might want to talk about how you cut on costs as a response and this may involve suggesting cheaper medication or fewer doctor visits. But they can only help if they know cost is an issue.

Check to make sure all your insurance needs are current. Healthcare insurance is not limited to a single plan that covers all your needs and can have other employment-based coverage, spouse’s coverage or be on Medicare and also have a Medigap policy, or Part D Rx coverage. Due to the large number of healthcare companies, it is only natural that in regard to some of them, important information is omitted. Check with each of the providers that have your details correct according to your insurer, Donovan goes further explaining.

Nearly everyone eligible for Part A and Part B enrolls in them when they reach 65 years of age, the Medicare program basic plan. These plans still require the beneficiaries to pay out of pocket such as; deductibles, copayments, and coinsurance. To counterbalance these expenses, the private insurers provide Medicare Supplement Insurance, otherwise known as Medigap, which ordinarily costs $150 a month, said Jack Hoadley, PhD, a research professor emeritus at Georgetown University’s Health Policy Institute.

Hoadley observes that Medigac can pay for many costs that regular Medicare does not; these costs include the 20 percent coinsurance for physicians’ services. In any case, according to the Kaiser Family Foundation, as of 2018, 20% of traditional Medicare beneficiaries had no supplemental coverage. “In fact for seniors, it’s important because it’s the way to avoid huge medical expenses,” Hoadley pointed out.

Good to know: In a related move, they should sign up for Medigap as soon as they are eligible for Medicare, according to Hoadley. When you initially sign up for Medicare Part B and have original Medicare, you can purchase Medigap without any preexisting conditions. If you wait until later to enroll, you may be required to submit to a medical examination, and your insurance claim could be rejected or premiums increased, depending on your pre-existing conditions.

If the plan mentioned above is not feasible financially then you can opt for Medicare Advantage. Such plans include Part A and B and may include Part D with the cost it also covers out-of-pocket expenses that traditional Medicare does not cover. There may be Medicare Advantage plans that come incorporated with the original Part B premium and may not have any additional costs.

However, it has to be mentioned that Advantage plans are offered by private insurance companies that work with Medicare, therefore a range of the doctors may be more restricted depending on the plan selected, and this list might change annually. “The idea is good if your doctors are networked,” added Hoadley.

The majority of Advantage plans offer prescription drugs and various levels of dental, vision, and hearing care. Moreover, they propose additional options such as a fitness center and adequately insure practically any other medical care once you have paid your configured price tag, which is your deductible. Deductibles could range from zero to several hundred, based on Hoadley’s research.

Good to know: You can sign up for Medicare Advantage when you first qualify at the age of 65, or when you have a permanent move from a skilled nursing facility, even if you have health problems. But if you change your mind and go back to traditional Medicare, you have to take a health screening for any additional coverage unless you are eligible for a waiver like moving to another state or if the Advantage plan you had is no longer offered.

Some Things to Do When Considering Medical Costs

Still, there are circumstances you could end up paying quite a lot of money for your healthcare. To navigate potential financial difficulties, consider the following strategies:

- Don’t Pay Bills Automatically: If you receive a bill from a hospital or provider, make certain the invoice was paid by, or submitted to, your insurance including Medicare, supplemental Medicare, Medicare Advantage, or private insurer. If you have insurance and you get a bill try and contact the provider to tell them that you have submitted the claim to your insurance. The next thing that your insurer should take to you is an explanation of benefits highlighting the remaining balance that you have to meet.

- Verify the Bill’s Accuracy: Thirty percent of medical bills have billing errors including charges doubled or incorrectly listed services that were never performed. It means if you get an enormous bill, ask for a receipt that has descriptions of the charges, and once received, read it word by word. If there are some disparities, do not hesitate to challenge the corresponding provider.

- Challenge Charges Related to Medical Errors: If you get a complication such as an infection arising from a hospital say, do not agree to be billed for any extra cost you incurred while being treated for the infection you got in the hospital. You can also ask if there is a discount policy for the first procedure especially if it had incurred you a bill or forced you some scarce time from work. Of course, there’s no certainty of getting a discount but it’s always good to try.

- Inquire About Financial Assistance Programs: Nonprofit hospitals have some legal obligation to provide financial assistance. The laws vary from state to state but over the years some states including California, New Jersey, and New York for instance require hospitals to offer services at discounted rates and at times for free to those with low income earners. Although living in a different state is not unusual, there is “nothing wrong with requesting some monetary support based on the circumstances, ” said Donovan. According to surveys, the hospital rarely volunteers information to patients about the available reimbursement programs.

- Negotiate Payment Plans: Some providers may be willing to discuss the payment plan with you. Determine how much you are willing and able to spend on rent after all things cheaper than rent such as shelter and food have been met. Also, it will important to ensure that no interest is charged on the balance. However, if you can afford to do so, negotiate for a cash payment and you will be offered a cheaper total bill of around 15% or less.

- Seek Assistance: A lot of free information exists to guide people through medical billing processes including compensation. For example, the Medicare Rights Center can help you better learn about and compare your available Medicare options. You can speak to them over the phone at 800-333-4114 or visit their website, medicarerights.org during business hours.

- SHIAP can also help you with the different Medicare Part C options as well as refer you to your state Medicaid office. Visit shiphelp.org to get your state’s contact information.

- Need help in understanding and learning how to manage your medical expenses? You may approach the Patient Advocate Foundation for free help. They can be contacted through an 800 number 800-532-5274 or a P.A venue at patientadvocate.org.

- Consider Hiring a Medical Advocate: Should you want one-on-one help, seek a medical billing specialist on the Alliance of Professional Health Advocates. Make sure that the advocate you hire is certified by the Patient Advocate Certification Board.