Sending Money to Europe: What You Need to Know

If you are transferring money for yourself, your friends, family or supporting a business, or even maintaining a property in Europe it is crucial to ensure that you get as many euros for your pound as possible.

Comparing one money transfer with another enables one to determine the available service that best suits him/her/its conditions. Some of the providers advertise low exchange rates while charging high fees hence the need to look for a provider who balances the two.

Secondly, choose the form of transfer, the delivery time to the European recipient, and, finally, the safety of the transferred funds.

In this guide on transferring money to Europe, we will dissect different approaches or techniques of transferring money and their strengths and weaknesses.

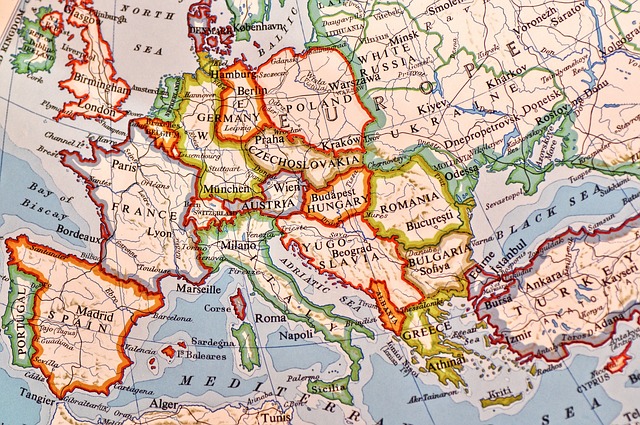

Is the Pound strong against the euro?

The pound has stayed reasonably fixed against the euro with the exchange rate ranging around £1 being worth roughly €1.19 at the time of writing (as shown below). This should be good news to those who require pay for goods and services in Europe since the pound increases the value of your money by buying more euros.

Nevertheless, in any case when the pound sterling exchange rate approaches the parity level – where £1 is equivalent to €1 – it is more expensive for British individuals to visit the eurozone nations, or to transfer money to these countries.

Which Are the Available Methods of Transferring Money to Europe?

There are also pros and cons of the available ways of transferring money to Europe. The option most suitable for you will depend on the amount you wish to surrender, destination country, and the time the funds are needed.

Here’s a summary of the main options:

- High Street Bank

Transfer of money through your UK bank is secure, fast, and reliable where online transactions may be possible. However, the rates, as well as fees provided by banks, are not as favorable as those of the independent companies. There is often a daily ceiling on intermittent transfers usually expressed in foreign currency although it is high.

One of the advantages of using your bank is that you’ll have deposit protection from the Financial Services Compensation Scheme (FSCS), which means that up to £85,000 per person per bank is protected in the event that the bank goes bankrupt.

- Multi-Currency Bank Account

So, for anyone who regularly transfers euros to Europe for a second home or a business, a multi-currency account with one of the UK’s major banks – Barclays, HSBC, or Santander – could be a good thing for you. Even international residents who are British may find this account useful if they have investments or pensions in the UK.

By operating multiple currency accounts for international payments you can pay large and recurring amounts in euros, and still enjoy FSCS protection. However, most of these accounts are suitable for wealthy people, and those that do not require the minimum income will charge fees for accounts and exchanging currencies.

- Digital Money Transfer

There is always an online service, such as Revolut or Wise, which in most cases charges less for transferring and converting money than a bank would. These providers work with the pedestrian population and have affordable services for small and occasional transfers as well as for big money transfers.

Revolut and Wise both facilitate real exchange rates and there is no transaction fee for instant transfers up to a certain amount. For even better transfer rates, there are subscription accounts at fast-growing Revolut which even boasts free travel insurance, and UK’s Starling Bank which charges 0.4% fees plus delivery fees which can be paid for priority delivery by SWIFT.

Wise is governed by the Financial Conduct Authority (FCA), but the service operator doesn’t provide FSCS protection. Proudly though, individuals and companies using the Starling Bank enjoy full protection from FSCS, and Revolut is expected to have FSCS coverage by 2025.

- Currency Brokers

Echoing the findings of this research specialist currency brokers which are also referred to as FX brokers usually offer more competitive exchange rates and lower transactional charges than those offered by high-street banks. These are relatively young and mostly are either online or linked with a mobile application that lets you transfer euros rapidly, although some of those mentioned have set a limit on the amount you can transfer at a go.

Using currency brokers, try to work with FCA-authorised ones, because client funds have to be segregated, so the clients will have some recourse if the firm collapses. Nevertheless, unlike banks, these brokers do not come under the FSCS protection plan.

Some of the well-known FCA-authorised companies are HiFX, Moneycorp, TorFX, and IG. Many brokers will provide a quote through the website and this makes it easier for you to compare the rates being offered by different providers.

- High Street Money Transfer Services

While MoneyGram and Western Union provide some advantages, owing to having branches, they are not the least costly ways of sending cash to Europe.

These services are convenient where the sender or recipient lacks a bank account through cash can be collected at agreed points. Being well established all over Europe, Western Union and Money Gram offer the convenience of directly facilitating the receipt of money in cash by the recipient.

However, its safe to say that its disadvantage comes with a hefty price, and is also dangerous to get these services. Fees can be high, thus exchange rates tend to be less competitive than other approaches and cash transfer has low maximum limits.

- PayPal

If you and your recipient both have PayPal accounts, PayPal’s Xoom service is an easy way to transfer money. In case the recipient does not have a PayPal account, the money can be delivered to his bank account, or for cash collection in some European countries.

Of course, sending money with PayPal is not free, and transferring money to another country can be especially expensive. As for the exchange rates, Xoom charges customers slightly higher rates than some of the other money transfer services out there, meaning this is costly. The cost of a transaction is relative to the amount of money being transferred and the method that is used in the transfer, so you should always check the charges of other companies before transacting.

As PayPal is an e-money provider for consumers, a digital service similar to many other ones, it is regulated by the Financial Conduct Authority (FCA), and therefore the funds that you transfer using PayPal are not protected by FSCS.

How Much Money Can I Transfer to Europe?

The quantity that you can transfer from pounds to euros is similar to the service provider that you select because each—right from the banks to the high street currency dealers—has uniform policies and optimum limits.

In the case of big transfers, it is better to choose between service providers to find the most suitable one to work with, remembering the safety and security of the transfer. This is especially important where a large amount of money can be transferred, so, for example, to purchase a property in another country. Please remember that transfers of a higher amount may also need either identification or some other documentation.

For smaller amounts of money transferred, fees could comprise a large percentage of some costs, so make sure to search for the cheapest provider.

When Will the Money Transfer Reach Europe?

The duration of the transfer of money to Europe depends on the provider that you choose and the means of transfer.

The transfer speeds differ with most providers having the option of transferring the cash at a slow rate and therefore, the prices for transferring increase with the speed at which the provider conducts the transfer. Currency brokers for instance will offer several possibilities and you can therefore select under which conditions you wish a delivery, bearing in mind that the speed usually comes with slightly higher costs.

It can take between 24 hours and two days to complete a standard bank transfer to a European bank account.

If you require the funds to be delivered faster – for instance, in an emergency – faster transfer services are there but they are costly. Money transfer companies such as Western Union and MoneyGram can help one make an instant cash transfer when you use a debit/credit card, which will enable the recipient to go to a location and pick up cash.

Is My Cash Transfer to Europe Safe?

In the case of sending your money for international money transfers via the UK’s fully regulated banks, your money is protected by FSCS, based on the terms and conditions of FSCS. This offers indemnification as high as £85,000 per individual per banking organization in case of a failure in the banking institutions.

Some service providers have their protection measures for your money, but habits’ safety may not be as extensive as the FSCS one and can miss certain assurances. So, the customer has to learn the level of security in the certain provider before passing money for the service.

Some of the most prevalent issues in the money transfer market are fraud and scams, so the identity of a provider should be checked. Make sure the company operates as an FCA-authorised and regulated financial firm. This assists in guaranteeing that they have put in place mechanisms for protecting your money in the event the company is hit by a financial crisis. A provider can be verified using the Financial Conduct Authority register.

Good work !

Such a wonderful article! I really appreciated the detail and clarity.