Top Car Insurance Companies for 2025

After comparing more than 50 of the best car insurance providers, here is a list of the best car insurance providers concerning coverage, price, satisfaction, and solvency.

Best Car Insurance Companies of 2025:

- Travelers: Best overall.

- Geico: Best for affordability.

- American Family: Best for low complaints.

- Auto-Owners: Best for financial strength.

- State Farm: Most suitable in serving customers.

- USAA: Best for military members.

- Travelers – Best Overall

Of the Car Insurance Companies, the most popular one for travelers is in 2025. It provides all the basics and is supplemented by such features as new car replacement and loan/lease gap. Travelers also offer a wide range of the discounts, ensuring that bargain-hunting drivers will find coverage that will suit them.

- Geico – The most affordable

Geico has the cheapest average full coverage price of $1,296 per year. But by having so many ways to knock dollars off your premium and strong online account management tools, Geico is the perfect option for cost-conscious drivers.

- American Family – Best for Few Complaints

In terms of efficiency, little complaint has been made against the American Family. There is a phone, email, and social media support availability and flexibility is assured.

- Auto-Owners – Best for Financial Strength

By gaining an advantage in the financial aspect, auto owners offer sound claims support. Five of the highest-rated companies for financial security are the given company, Geico, State Farm, Travelers, and USAA.

- State Farm – This is the insurer that will make its customers happiest.

State Farm is the biggest auto insurer in the United States and the company often ranks highly in the J.D. Power studies of customer satisfaction.

- USAA – Best for Military Members

The insurance provided by USAA comes with cheap rates and has the customers’ satisfaction. Additional perks include discounts for parking your car on militar bases as well.

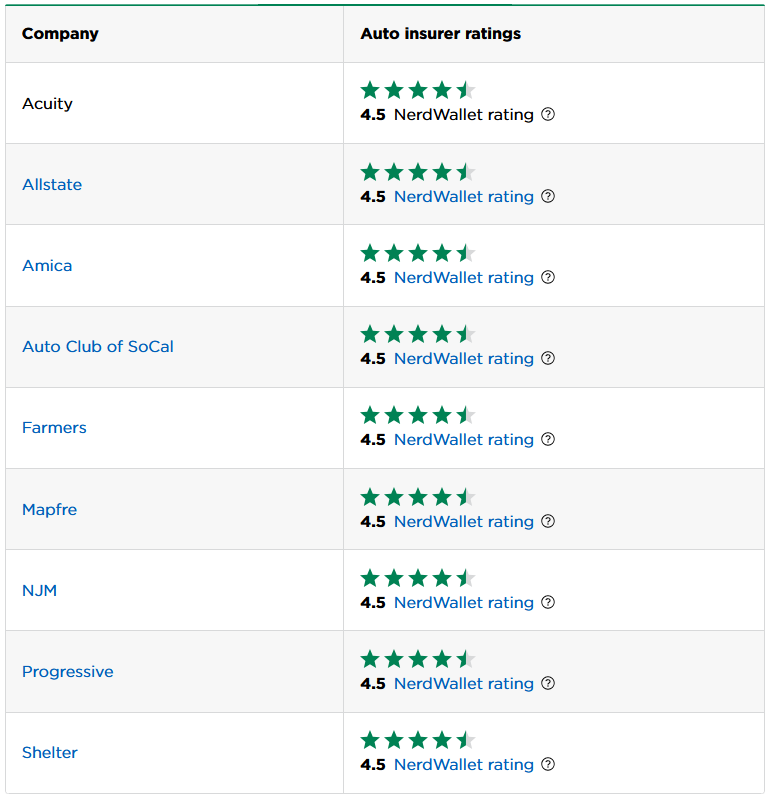

Honorable Mentions:

Our team has also given a 4.5-star rating to several other first-ranking insurance providers. While they may not offer the best coverage in any one category these companies do provide options that may appeal for comprehensive coverage.

The Best Car Insurance Companies across a few States

Insurance for cars varies by State, thus the top insurance companies in the US may not be suitable for you. In terms of auto insurance, we reviewed and compared existing states with the best insurance companies where users can compare based on ratings, cost, satisfaction, and user-friendliness.

Best Car Insurance Companies in:

Arizona

California

Colorado

Delaware

Florida

Georgia

Massachusetts

Michigan

Nevada

New Jersey

New York

North Carolina

Pennsylvania

Texas

Utah

Wisconsin

Hearing from Reddit: Which Car Insurance Companies are the Best?

Comprehensive information to discuss car insurance providers with different perspectives can be found in the Reddit forum, where people stay anonymous. Again, people have their own opinions, though some general directions can be defined. For instance, USAA is admired for claims services and OEM parts accessibility for newer cars; which makes it perfect for military-class families. , customer service is fast, and the company offers cheap insurance; Progressive – this company offers affordable insurance and provides reasonable compensation after the policyholders made a claim. Please remember that the insurance experience can be completely different, and the best way is to compare prices offered by different insurance companies.

Car insurance tips for the best cheap rate

Choosing what car insurance policy to take is the task of making sure that the client gets the best deal. Here are a few tips to guide your search:

Compare Quotes: It is wise to check with your car insurance company about costs based on your age, your record, and car model. This means that when you are shopping around you will be in a position to identify the most cheap price.

Review Customer Complaints: Look at the particulars provided by consumers through website complaints sections or refer to the NAIC to ascertain that a given company handles complaints well.

Consider Smaller Insurers: Do not blind yourself out of large insurers because some smaller ones can be quite equally affordable and focused.

Timing Matters: Surcharges can occur if you’ve had some moving violation, so you should begin to shop for new rates after three to five years when the surcharges are the highest.

Check Your Coverage: Check your coverage by discussing the policy with an agent or representative to ensure that you are not the opposite of underinsured or overinsured.

Here’s How We Picked the Best Car Insurance Companies

To determine the best car insurance companies, we evaluated several criteria:

- Financial Strength (30%): A company’s ability to pay claims is critical. We used ratings from agencies like AM Best and Moody’s to assess financial stability.

- Customer Complaints (30%): Companies with fewer complaints provide a better overall experience. We used data from state insurance regulators.

- Ease of Use (20%): We considered how easy it is to get quotes, file claims, and use the company’s mobile app.

- Affordability (20%): The best companies offer multiple discounts and competitive pricing.

This evaluation ensures you receive reliable, affordable coverage from insurers that prioritize customer satisfaction.